Report reveals spending trends

May 25, 2018

Biocidal products update

May 25, 2018Michael Kinsella – a partner in the firm of BCA, Chartered Accountants and Business Advisors – has over 25 years’ experience in providing advisory services to SME firms specialising in construction and construction services. In this issue of The Hardware Journal, he takes our readers through the ins and outs of The Central Credit Register.

Background

The lack of a centralised source of credit data was identified as one of the main culprits for catastrophic lending, as banks and other institutions were not able to see the full borrowing history of companies and individuals. In the clean-up following the financial crisis in 2008, the Irish Government gave a commitment to the International Monetary Fund and other supporting parties to the bailout programme in 2010 to introduce a system that would facilitate the collection and centralisation of information on credit. This commitment resulted in the passing of the Credit Reporting Act 2013, which resulted in the formation of the Central Credit Register. It is envisaged that the Central Credit Register will contribute to financial stability and consumer protection by providing lenders with a better analysis of borrowers’ creditworthiness, giving information to borrowers on their financial profile, giving the Central Bank better insight into financial markets and supporting the Central Bank’s role of supervising the financial sector and ensuring financial stability.

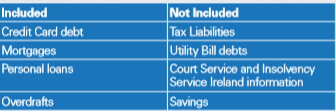

Debt Included and Not Included

Initially, Hire Purchase Loans and Personal Contract Plans (PCPs) will not be included, but it is intended that these will be included in the near future. All loans and guarantees are included on the Central Credit Register if the loan is for €500 or more and the borrower lives in the State at the time of applying for a loan, or the loan agreement or loan application is governed by Irish law.

Lenders

Over 500 lenders are included on the Central Credit Register, such as asset finance houses, banks, credit unions, firms that have acquired loan books from Irish financial institutions, moneylenders (licenced only), local authorities, and NAMA.

Types of Borrowers and Loan

The borrowers which will be included on the Central Credit Register are Companies, Individuals, Partnerships, and Sole Traders. The register will also extend to other entities such as clubs and associations that are resident in the state, or credit agreements governed by Irish law. In addition, personal guarantees and indemnities will be included.

How it will work

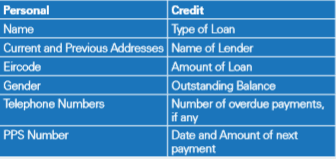

It will be used to collect and store personal and credit information on loans of €500 or more from lenders. From 30th June 2017 and every month thereafter, lenders have had to submit information to the register to enable the updating of your comprehensive credit report. The credit report will help lenders when it comes to making decisions about loans and loan applications. However, it is worth noting that The Central Credit Register does not give a credit score.

Credit Reports

Credit reports are now available for borrowers and lenders to request. These can be requested online through www.centralcreditregister.ie and certified confirmation of identity, address and PPS number will be required to obtain a copy of the report. Lenders can access a credit report when there is a new loan application, a loan restructure, when arrears have occurred, or in cases of other breach of facility or default. A Credit Report will contain the following information:

A log of all the dates that a Credit Report has been requested, by whom, and purpose of the enquiry is maintained on the register.

Conclusion

As well as providing useful information to lenders and supporting the Central Bank in managing credit in the economy, credit reports can also be a useful tool for members when opening or reviewing accounts for their customers. However, this information will have to be provided on a voluntary basis and members should ensure that the information is gathered, used and retained only in accordance with The General Data Protection Regulation which comes into effect on 25th May 2018.

For more information, you can contact Michael at MichaelKinsella@bca.ie.

This Business Support article featured in the May/June 2018 edition of The Hardware Journal.